The Federal Government efforts at returning the oil and gas sector its past glory in the area of investment may have started yielding fruits as it claimed that it has attracted td over $8 billion in deepwater oil and gas Final Investment Decisions (FIDs) in less than one year.

This a significant testimony underscoring recent presidential actions to remove the existing bottlenecks in the sector.

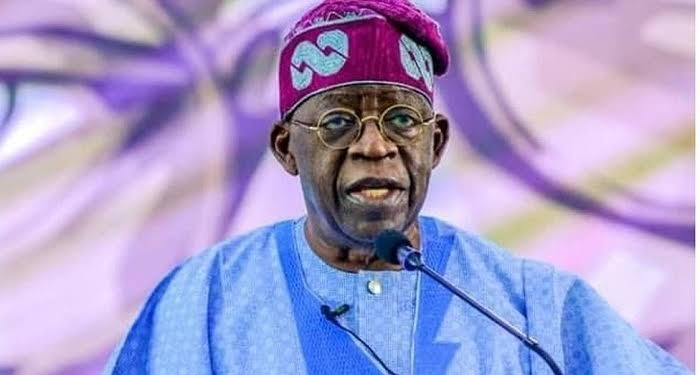

Olu Verheijen, Special Adviser on Energy to President Bola Tinubu, who disclosed this at the just recently concluded 2025 Africa CEO Forum in Abidjan, Côte d’Ivoire, explained that Nigeria has recently focused on improved fiscal terms, streamlined contracting timelines and greater clarity to local content rules.

According to a statement signed by Senan Murray, the Team Lead, Communications, Office of the Special Adviser to the President on Energy, it stated that as a result of these reforms, including the restructuring which is enabling gas-to-power commercial viability, “We moved from gridlock to greenlight, and investors responded.”

Delivering her message to policymakers, investors, and industry leaders across the continent, Verheijen insisted that “Capital is not African or foreign”, explaining that “It is rational; and Africa must compete for it.”

Multi-billion-dollar deepwater and LNG projects are global capital territory, Verheijen said, and Africa must partner smartly, not from dependency, but from aligned strategic interest.

Citing the fact that Africa attracted $340 billion in upstream capital between 2011 and 2015, a figure expected to drop to less than $130 billion by 2026–2030, she described it as “not a funding winter”, but “a structural decimation.”

The Special Adviser to the president, she said, capital is increasingly going to projects with strong economics, low carbon intensity, and predictable governance—the factors attracting billions of dollars in new investment to the Permian Basin, Guyana, and Brazil.

She argued that if Africa wants a larger slice of the $500 billion in global upstream spend annually, it must offer the same clarity and competitiveness.

Verheijen noted that Nigeria has been able to prove that this approach works. “In under a year, Nigeria unlocked over $8 billion in deepwater oil and gas Final Investment Decisions (FIDs) through decisive presidential action, focused on improved fiscal terms, streamlined contracting timelines, greater clarity to local content rules, and power sector reforms enabling gas-to-power commercial viability,” she was quoted as saying.

Verheijen urged African investors, Development Finance Institutions (DFIs), banks, pension funds, and sovereigns—to be strategic in focus, and to strive to fill the vacuum left by International Oil Companies (IOCs), not just with funding, but with fit-for-purpose instruments and risk-sharing structures.

“Our sweet spot is onshore, shelf, and domestic gas. That’s where African players must dominate, because we understand the terrain, the risk, and the reward,” the presidential aide maintained.

She also celebrated the feats of African private sector champions, like Seplat, Oando and Renaissance, who she argued are no longer just “local players.”

Renaissance Africa Energy Consortium’s acquisition of Shell’s onshore JV, she said, represents “a symbolic transition from colonial-era concessions to indigenous control.”

On the new 650,000 barrels per day Dangote Refinery, the largest single-train refinery in the world, she said it was: “Built by African capital, African hands, and African ambition,” noting that “this is not just infrastructure, it is proof that African industrial scale is not aspirational. It is operational.”

Seplat’s recent 390 mmcfd gas supply deal with the Nigerian National Petroleum Company Limited (NNPC), she said, I’d “not just output”, but “energy security”.

“Nigeria’s attainment of an increase in indigenous equity in gas, from 69 per cent to 83 per cent, is not just a statistic but instead a seismic shift in ownership and control of Africa’s energy future,” the special adviser explained.

“But global capital still matters. International Oil Companies, which still account for over 50 per cent of production and capital expenditure in sub-Saharan Africa, are now showing signs of an evolving approach.

“They’re no longer chasing barrels. They’re chasing value: low-cost, low-carbon, (and) de-risked assets. Let’s be realistic: Africa cannot negotiate terms on capital that hasn’t yet arrived. Investment must come first; returns and benefits will follow,” she pointed out.

Verheijen posited that Africa must move beyond sentiments, consciously pursue clarity in policy and be strategic in its intentions, insisting that nobody will give Africa the future, but that it must be built deliberately.

“We must move beyond appeals for support. Africa must become an investment destination by design; anchored in policy clarity, commercial logic, and strategic intent. When we get that right, capital won’t hesitate, it will pursue us. The future will not be given to Africa. It must be built—deliberately, unapologetically, and on our terms,” she stated.

Meanwhile, Nigerian oil and gas service providers have started jostling for a share of contracts in three big projects currently ongoing in the nation’s upstream petroleum sector, including Shell’s $5 billion Bonga North and $122 million Iseni Gas Projects, as well as TotalEnergies’ $550 million Ubeta Gas Project.

Chairman of the Petroleum Technology Association of Nigeria (PETAN), an umbrella body of the local service firms, Mr. Wole Ogunsanya, disclosed this to reporters during the PETAN Golf session at the just-concluded Offshore Technology Conference (OTC) held in Houston, Texas, USA.

This was just as Ogunsanya, who is also the Chief Executive Officer of Geoplex, revealed that Nigeria’s participation at the yearly OTC conference has attracted over $8 billion investments to the country’s oil and gas sector.

There were three landmark FIDs in the Nigerian upstream oil and gas industry in 2024 starting with the Iseni project in February, followed by Ubeta in September and Bonga North in December.

Already, Shell has awarded a $1 billion contract from the Bonga North project to Italian company, Saipem, in a consortium with two Nigerian contractors – KOA Oil & Gas and AVEON Offshore.

Responding to THISDAY’s question bordering on the opportunities the projects present to the industry and how the local service firms were taking advantage of those opportunities, Ogunsanya admitted the three projects were significant to the country’s oil and gas industry and PETAN members because of the huge opportunities they presented.

He said the companies have already keyed into the Nigerian Petroleum Exchange (NIPEX) portal and anticipating contracts that match the capacities built by his member companies in terms of equipment and products as promoters of local content in the industry.

NIPEX is an electronic contracting platform and a one-stop transaction center for the Nigerian oil and gas industry domiciled at the NNPC Upstream Investment Management Services (NUIMS).

“For PETAN members, we call ourselves think-tank organisations, due diligence organisations and companies. We’ve already logged into the tendering process of all this work”, he said.

Further according to Ogunsanya: “When you take FID, the process of tendering – who does what, is already there on NIPEX and the bidding system that we have in the country. And we’ve worked with NNPC, NUIMS.

“We’ve managed to establish a high level of decorum. Sometimes we align with NIPEX to make sure the codes for you to be able to bid and all that are all sorted out. So, our members are already keyed into the tendering system, and it makes sense.

“We don’t want anything handed over to us on a platter of gold. We want to show that we have the capacity to do it. We want to be fair to every other company in the industry”.

Noting that his member companies were also competing with other firms providing services in the industry despite priding themselves as drivers of local content, he said his members still needed to observe due diligence in the tendering process.

According to him, PETAN companies enjoy the advantage of having more investments, more equipment and more trained personnel in the industry compared to others.

“So, we’re commanding our own share of the market. So, we are keyed into the tendering system, and we’re going to be part of those projects. Some of those contracts are already awarded, and there is a number of PETAN companies that are already in the play for the contracts that will emanate from this FID. We’re doing something higher than that”, the PETAN chairman explained.

As part of proactiveness, Ogunsanya said his association has created a committee called Business Strategy Committee (BSC).

He explained the committee is saddled with the responsibility of looking for his members’ interest in the contracts emanating from the projects, particularly the $5 billion Bonga North project being promoted by the Shell Nigeria Exploration and Production Company Limited (SNEPCo) and what comes to his member companies.

He said his members deserved a sizeable amount of the jobs from the projects owing to their capacity in local content.

According to him, PETAN firms were over 60 per cent in terms of local content when all indigenous companies were aggregated, arguing – “And you’re doing a $5 billion project. If you do the math, we should be commanding a lot of those projects.”

On that note, he said his member companies should be prioritised by allocating at least 25 to 30 per cent of that $5 billion project to them to reflect the capacity they have built over the years.

Ogunsanya further explained: “So this committee is responsible to look at each of the FIDs, the projects that are coming up to make sure that the award is commensurate with the capacity that we have built.

“I can give you an example. If you invested to build capacity but you’re not getting your quota, it’s not fair. You’ve invested in the system to make sure that the capacity is there in the system. The award system does not match your investment – your capacity, versus the work that is there.

“So, with that PETAN BSC committee, that’s their job. And we are telling them, don’t ask for 100 per cent of the PETAN contribution. Ask for something lower. So that it will be very clear that we’re asking less than what we deserve, and the way we’re asking, we said, no, we’re not going to change the system.

“There is a tendering system. There is NIPEX. Everything is there. They will check your technical capacity. You submit commercial. And then you grade everybody. We will participate in that. We’re encouraging our members to go and tender for everything.

“But at the time you’re aggregating the work, at the IOC level, for instance, SNEPCo, at NCDMB, tell me how many PETAN members have won in that $5 billion project. Add all the numbers together. How much is it? Is it $500 million? Is it $800 million? Is it $1.5 billion? If it’s not up to the target we set, give us the right of first refusal.”

He added: “Maybe we didn’t come first. Maybe we came second, third, fourth. So, give us the right of first refusal. We’ll go and ask our members and say, this job, you said $10 million. They said if you accept $9 million, they will give it to you.

“So that gives us the opportunity to say yes or no. And we are doing that deliberately to make sure that we are not claiming right or anything. We want it to be done due diligently.”

Meanwhile, Ogunsanya announced that PETAN’s consistent presence at the OTC in US has attracted investments worth over $8 billion in Nigeria’s oil and gas sector.

He explained that the $8 billion in investments stemmed from equipment purchases, service partnerships, and project funding facilitated through relationships built at the OTC.

He recalled that last year, PETAN supported the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) with their roadshow, and that all the oil fields the agency presented were fully subscribed.

“This is why we are here annually, to connect with the global oil and gas community and bring value back to Nigeria,” he noted.

Ogunsanya further said that PETAN recently concluded a funding agreement for member companies to acquire equipment, adding that a new collaboration was initiated with Senegal, developing its offshore gas infrastructure.

“The future of Nigeria’s oil and gas industry is bright,” he said, adding: “There’s a shift underway with divestments from international oil companies to indigenous firms, and we see it as an opportunity, not a setback.”

He stressed the importance of increasing and sustaining national production, targeting 2.5 million barrels to 3 million barrels per day regardless of global oil prices.

He also highlighted current refining efforts, pointing to a projected refining capacity of 1.4 million barrels daily, including the BUA Group’s ongoing construction of a 350,000-barrels per day refinery.

Promising that PETAN cannot afford to be passive in the efforts to grow the industry, Ogunsanya said the association was working tirelessly to support its members in acquiring critical equipment and raising funds.

He acknowledged that the federal government, NNPC and Nigerian exploration and production companies were united in the mission.

“Our goal is simple: to secure sustainable oil production and revenue generation to support national development.

“The era of halting production due to price fluctuations must end – we must be resilient, consistent, and forward-thinking”, he added.